What is Accelerator Oscillator (AC)

The Accelerator Oscillator measures the acceleration or deceleration of price momentum.

It’s designed to show momentum changes before the price actually reverses — meaning it’s often an early warning tool.

It’s derived from the Awesome Oscillator (AO):

…. so AC shows how quickly momentum is speeding up or slowing down.

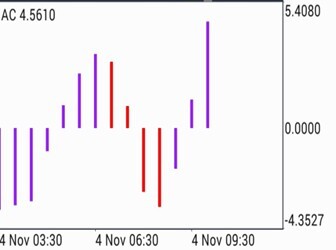

📊 How to Read the AC Histogram

You’ll see vertical bars (usually red and blue or green) oscillating above and below a zero line.

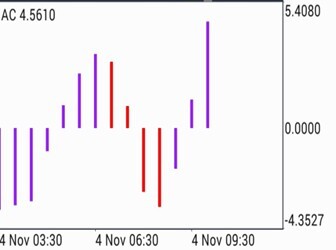

🔹 1️⃣ Above the Zero Line

- Market momentum is bullish (price tends to rise).

- If bars grow taller upward (increasing) → momentum accelerating up → possible buy opportunity.

- If bars shrink → bullish momentum slowing → possible pause or correction.

🔹 2️⃣ Below the Zero Line

- Market momentum is bearish (price tends to fall).

- If bars grow taller downward (increasing in negative) → momentum accelerating down → possible sell opportunity.

- If bars shrink → bearish momentum weakening → possible rebound soon.

🎨 Color Interpretation

- Blue (or Green) Bars: Momentum is increasing (acceleration).

- Red Bars: Momentum is decreasing (deceleration).

Each color change means the speed of the price move is changing — before the price itself turns.

🧭 How to Trade Using the Accelerator Oscillator

✅ Buy Setup

- Look for blue/green bars forming above the zero line — showing strong upward acceleration.

- If bars were red before and turn blue, it’s an early bullish signal.

- Confirm with:

- Parabolic SAR dots below candles, or

- Stochastic turning up from oversold.

📈 Entry idea: Buy when two consecutive blue bars appear above zero.

✅ Sell Setup

- Look for red bars forming below the zero line — showing strong downward acceleration.

- If bars were blue and turn red, it’s an early bearish signal.

- Confirm with:

- SAR dots above candles, or

- Stochastic turning down from overbought.

📉 Entry idea: Sell when two consecutive red bars appear below zero.